"Stang70Fastback" (Stang70Fastback)

"Stang70Fastback" (Stang70Fastback)

04/10/2016 at 09:59 ē Filed to: None

50

50

100

100

"Stang70Fastback" (Stang70Fastback)

"Stang70Fastback" (Stang70Fastback)

04/10/2016 at 09:59 ē Filed to: None |  50 50

|  100 100 |

Today I received a very frustrating letter in the mail. Before we get to that, though, letís back up a few steps, and take care of some of the basic questions people ask whenever you start talking about insurance:

I am 27, and Iíve been with GEICO in some form or another since I started driving. I have no tickets on my license. I have two claims on my insurance. The most recent is a comprehensive claim from a few months ago when another car hit a piece of debris on the road, which then bounced into my door, not causing a dent, but putting a nice 4Ē long scratch through the paint. The other is from just a few months shy of 5 years ago, when another vehicle hit me, for which I was found not at fault (he tried to go around me as I was turning left, and hit the side of my car.) I currently qualify for GEICOís accident forgiveness program. My payments are automatically scheduled, and never late.

Thatís all of the skeletons in my closet. I am, for all intents and purposes, a good GEICO customer. Except apparently Iím not, because I autocross.

For the uninitiated, autocross isÖ well, letís quote the SCCA Solo Rulebook:

ďA Soloģ Event is an automobile competition in which one car at a time negotiates a prescribed course, with finishing position based on the time required to complete the course plus any penalties incurred. Where course conditions permit, more than one car may be on course at a time if they are separated by adequate time and distance. A Soloģ Event is a non-speed driving skill contest such as, but not limited to, autocrosses and slaloms. These events are run on short courses that emphasize car handling and agility rather than speed or power. Competition licenses are not required and hazards to spectators, participants, and property do not exceed those encountered in normal, legal highway driving. All Soloģ Events must be SCCAģ sanctioned.Ē

If youíre still unclear about what autocross is, itís basically an empty parking lot, where cones are placed to form an obstacle course that you then drive through as quickly as possible. Itís essentially the safest form of fun you can have with your car. You arenít messing around on public roads, putting yourself and others at risk. You arenít on a race track where one wrong move can send you backwards into a tire wall at 100 MPH. Nope. Youíre in an empty parking lot with a bunch of cones. Itís about as safe as you can get. Itís so safe that parking lots with cones are the

first

place they bring people when they are first learning how to drive!

I participate in autocross. I think itís great fun, and a fantastic way to learn proper car control in a safe, and controlled environment. In fact, itís such a good tool, that I sometimes wondered if I could get a discount on my insurance for participating in them, much how you can get a discount for taking certain defensive driving courses. Iíve also participated in winter autocross, which is sometimes called ice racing, but itís essentially the same thing: a vast, open frozen lake, with some cones marking a course that vehicles individually navigate. Thatís an even better tool for teaching you how to drive on slick roads in the winter. Things I have never participated in include track days, or any form of wheel-to-wheel racing.

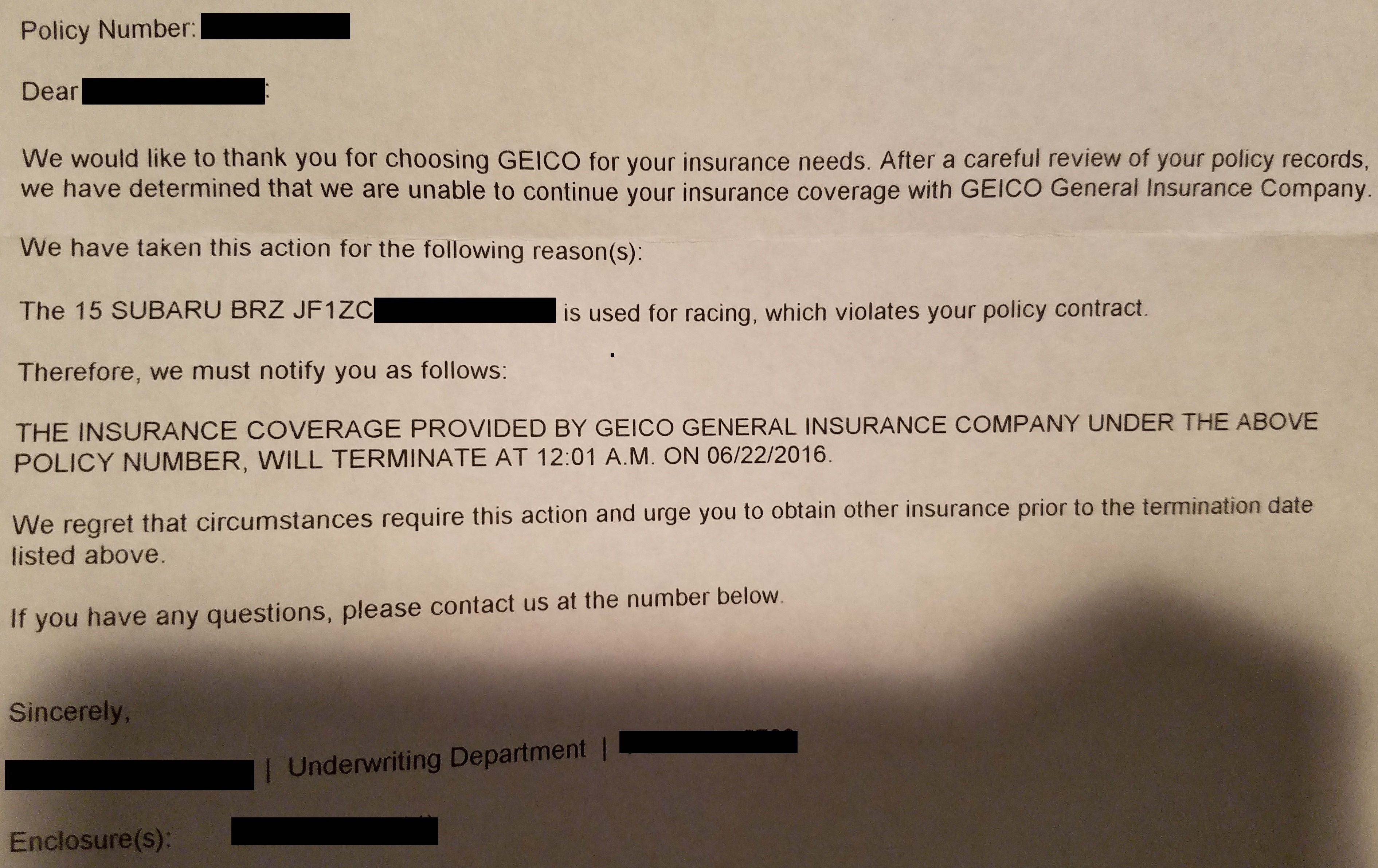

This is why I was shocked to receive this letter in the mail today:

Thatís right. GEICO has reviewed my ďpolicy recordsĒ and determined that I race my car, which violates their contract, and as such they have decided not to renew my policy. This really does come out of nowhere for several reasons:

1. I have been autocrossing for a while. I did quite a few of them last year, and Iíd done a handful before that. I know TONS of people who do the same, and Iíd personally never heard of this happening to anyone - at least not for autocrossing.

2. My only claim in the last four years was for a small scratch in the paint, so itís not like Iíve been randomly claiming damage left and right that could raise suspicion of being racing-related.

3. I canít find anywhere in my contract that actually states you canít race the car anyway.

This third point is really bothering me. GEICO claims that my BRZ ďis used for racing, which violates [my] policy contract.Ē They are explicitly stating that the reason they are not renewing my policy is because I violated the contract by racing my car. I have looked over my contract three times ( !!!error: Indecipherable SUB-paragraph formatting!!! ), and Iíve only found four instances of anything being mentioned with regards to racing. I have quoted them here:

In the Liability Coverages section:

ď[It does not apply] to bodily injury or property damage caused by an auto driven in or preparing for any prearranged or organized racing, speed, or demolition contest or stunting activity of any nature.Ē

In the Auto Medical Payments section:

ďWe do not cover bodily injury or property damage caused by an auto driven in or preparing for any prearranged or organized racing, speed, or demolition contest or stunting activity of any nature.Ē

In the Physical Damages Coverage section:

ďThere is no coverage for any loss caused by participation in or preparing for any prearranged or organized racing, speed or demolition contest or stunting activity of any nature.Ē

In the Uninsured Motorist Coverage section:

ďThis coverage does not apply to damage caused by an insured2s participation in or preparation for any prearranged or organized racing, speed or demolition contest or stunting activity of any nature.Ē

So essentially, they wonít cover any claims or incidents that are a result of my participation in any racing event. Which is fine, and reasonable, and what I always knew to be true. Nobody expects insurance to cover that. Thatís why people buy track day insurance. However, none of these statements translate into ďyou cannot race your car,Ē and if anything suggest the opposite, since it seems like they are intentionally excluding incidents stemming from racing in their coverage, as if to say, ďjust know that if you wanna do that stuff, we arenít covering it.Ē

I realize that insurance companies generally have the right to refuse to renew your coverage for any reason. What really rubs me the wrong way is that they explicitly listed the reason as being that I violated my contract by racing my vehicle. Iím not so sure autocross counts as racing, but even if it does, NOWHERE in the policy does it state you can not use the vehicle in that manner. It simply says they wonít cover damages or claims related to those activities. I would be less annoyed if they had said they were dropping me ďjust because,Ē because at least then they wouldnít be accusing me of something I did not do.

I will definitely be calling and asking them to point out the clause in my contract that says I cannot race my vehicle. Iím also curious to find out what proof they have that my BRZ is used for racing. I donít think autocross should count, but in any event Iím really curious to know what it was that caused them to freak out on someone who has been a good, loyal, money-making customer for them for many, many years. Whether itís my blog where I post videos of my autocross runs, or something else floating around the internet, or what... Iím not looking to deny that I do it - I just want to know what it was that they didnít like, specifically. The only thing that really comes to mind is this post my friends pointed out, where I used the word ďracingĒ to describe a weekend of autocross:

What a great way to end a miserable evening. Ironically, I just spent 1.5 hours on the train to get home from work, because I decided not to drive today since we might get some freezing rain tonight, and I didnít want to risk driving my car on summer tires in icy conditions. (Youíre welcome, GEICO. Iím always looking out for you guys...)

UPDATE: So I just got off the phone with their underwriting department, and I have answers to the two big questions.

1. How did they suddenly find out?

To GEICOís credit, it turns out this isnít nearly as creepy as I and others thought, and it is in fact my doing. Back in January I called GEICO to ask about adding $2500 worth of additional coverage to the car to insure a new set of wheels. The representative I was speaking to at the time seemed pretty cool. He asked me what wheels they were, and I told him, and he said, ďOh, wow those are nice. Iíve got XXXX on my car.Ē He sounded like a car guy. We got to talking while he worked on his machine, and at some point autocross came up. Apparently he forwarded the details of that conversation to GEICOís underwriting department, and thatís that. I had completely forgotten about this conversation until she told me about it.

2. What is their explanation regarding the contract?

I asked her to point out the specific clause that I supposedly violated by racing my car, and she referred me to the four statements I quoted in my original post. Her explanation was that those statements mean that they wonít cover damage caused my racing if they found out I was racing after I filed a claim. However, she said if they find out I race beforehand, they will drop me. She didnít seem to want to be bothered with pointing out where it says I canít race the vehicle at all. At this point, I donít really care anymore. I just want to move on, and hopefully find someone who is okay with my using the car for this purpose, with the understanding that damage resulting from those events isnít covered.

FINALLY: I want to point out that this was originally just a ďknee-jerk reactionĒ post to Oppo to vent my frustration. I never expected it to be picked up and thrown around Gawker. If Iíd know that, I would have at least waited to post until AFTER I had found out all the details, or maybe I wouldnít have posted at all. I appreciate everyoneís feedback.

I do think that it would be neat if the SCCA could work with at least one major insurer to come up with some sort of mutual agreement that works for everyone. At the end of the day, lots of people do these sorts of things. One of the ďselling pointsĒ for autocross is that you can show up with your daily driver, have some fun without really risking anything, and then go home. If doing all this, however, puts you at risk of your insurance being dropped, thatís not terribly appealing. I also find it amusing that any idiot with three speeding tickets on their record can go out and buy a Hellcat, and have that insured as a daily driver without issue. Conversely, I, with no tickets on my record, canít take my low-powered BRZ to an autocross once a month without being dropped even though all that does is make me a safer driver. Sucks.

Also, does anyone have suggestions about which insurance providers I should look into going forward? And should I be up-front with the use of the car, and try to work out some sort of agreement of ďwe wonít cover racing damages?Ē Or am I better off not mentioning it?

I run a blog too,

!!!error: Indecipherable SUB-paragraph formatting!!!

, so I do post publicly about the things I do. It wouldnít be fun to not share my experiences!

yamahog

> Stang70Fastback

yamahog

> Stang70Fastback

04/10/2016 at 10:03 |

|

This is interesting. Wonder if theyíre querying MotorsportReg for names/cars that match their customers or something?

jkm7680

> Stang70Fastback

jkm7680

> Stang70Fastback

04/10/2016 at 10:04 |

|

Next time put your lame in as ďMike LitorisĒ or something so they donít know itís you.

Hot Takes Salesman

> Stang70Fastback

Hot Takes Salesman

> Stang70Fastback

04/10/2016 at 10:05 |

|

Weíd better hope thereís intelligent life up there in space cause thereís bugger all in your GEICO office

Santiago of Escuderia Boricua

> Stang70Fastback

Santiago of Escuderia Boricua

> Stang70Fastback

04/10/2016 at 10:06 |

|

Crazy. I have active insurance on my rally car through progressive though. Cheapest I found in Michigan

Shoop

> Stang70Fastback

Shoop

> Stang70Fastback

04/10/2016 at 10:10 |

|

This is America. Sue.

TractorPillow

> Stang70Fastback

TractorPillow

> Stang70Fastback

04/10/2016 at 10:11 |

|

Any family serve in military (parents, grandparents)? If so USAA is wonderful for insurance.

fourvalleys

> Stang70Fastback

fourvalleys

> Stang70Fastback

04/10/2016 at 10:12 |

|

You did kind of mention it, but it should be clear that GEICO probably investigated a bit after paying out a (small) comprehensive claim for your car in January. They probably saw a blog post or a public Facebook post where you said:

ďIronically an entire weekend of racing the car was fine. Then I get hit by flying debris on the way home.Ē

They see "racing" and it makes them antsy. Especially if there's damage that coincidentally happens on the same day as an event.

Your argument is that they didnít explicitly say youíd be dropped for using the car that way. Maybe true - but like you said, they can drop you for anything. Or just jack up your rates. If they think youíre a risk of damaging your car and filing a claim, it makes sense that theyíd do that. And they know you wonít take them to court over it.

So, youíve got two steps:

1) call them and tell them that it isnít really ďracingĒ since none of it is wheel-to-wheel. Hope they apologize for the misunderstanding and continue coverage.

2) if they stand by their letter... Cut and run. I'd probably do this anyway.

The bad part is that you canít cancel immediately without paying a cancelation fee. Just another reason Iíve always told you how much I love GEICO!

-this space for rent-

> TractorPillow

-this space for rent-

> TractorPillow

04/10/2016 at 10:19 |

|

Not if you autocross

http://rennlist.com/forums/997-forÖ

Chasaboo

> Stang70Fastback

Chasaboo

> Stang70Fastback

04/10/2016 at 10:19 |

|

They kind of have a point. Racing is racing.

Aaron M - MasoFiST

> Stang70Fastback

Aaron M - MasoFiST

> Stang70Fastback

04/10/2016 at 10:20 |

|

I had GEICO as my insurer for my first couple years after grad school. Honestly...take this as a sign and get a real insurance provider. And thank God youíre not going to go through this BS while trying to resolve a claim and having your car held hostage as a result.

Flavien Vidal

> Stang70Fastback

Flavien Vidal

> Stang70Fastback

04/10/2016 at 10:20 |

|

Autocrossing would be considered racing fairly easily. You are racing against the clock and there are standings at the end of the day. That would be racing. Jut like rallying is racing, despite the fact that they are only racing the clock.

As far as your contract goes, their reason to not renew it is bonkers. Racing is not covered. Itís not forbidden. Itís clear enough.

Unfortuantely for you, they are not dropping your insurance. They donít want to renew it. They have the right to do it, and 99% of the reasons theyíll tell you will be something you wonít be able to fight in anyway, even if itís wrong. (ďWe wonít renew your insurance because youíre black, gay and transsexualĒ... That, you could fight it for discriminations... Pretty much anything else: they can legally do it)

Chris_K_F drives an FR-Slow

> TractorPillow

Chris_K_F drives an FR-Slow

> TractorPillow

04/10/2016 at 10:21 |

|

I have them for my banking, and am thinking about having them quote me for insurance to see if theyíre cheaper than Progressive.

TractorPillow

> -this space for rent-

TractorPillow

> -this space for rent-

04/10/2016 at 10:28 |

|

Oh. My bad. Do any of the big ones cover it?

Steve in Manhattan

> Stang70Fastback

Steve in Manhattan

> Stang70Fastback

04/10/2016 at 10:28 |

|

I wouldnít call them directly - have your agent do it, because the agent is directly interested in keeping you. On the other hand, does GEICO have agents?

You might need some sort of specialist enthusiast insurance that covers you. You donít want to self-insure - a lawsuit could ruin you.

Finally, while your policy doesnít specifically promise coverage when racing, an insurance company can be sued nonetheless. Anyone can sue anyone else for anything. And insurance defense costs.

Nibby

> Stang70Fastback

Nibby

> Stang70Fastback

04/10/2016 at 10:28 |

|

They just donít want you running over any wandering geckos.

nafsucof

> Stang70Fastback

nafsucof

> Stang70Fastback

04/10/2016 at 10:29 |

|

Screw those guys. Do they have proof of pictures showing your plates while autocrossing? Iíve gotten lazy about pulling my plates but will from now on. I use 21st century they were 20% cheaper than geico for me and my wife.

My X-type is too a real Jaguar

> Stang70Fastback

My X-type is too a real Jaguar

> Stang70Fastback

04/10/2016 at 10:29 |

|

I recommend Progressive, Iíve had them for 20 years had a couple of really major claims, several tickets and theyíve never dropped me or raised my rates. I pay the same per term now that I did 20 years ago with the difference is now I have no tickets and drive a 535i then I had 4 tickets in one year and drove a Saturn SL1. On a side note never file a comp claim on any damage under $1000.

TractorPillow

> Chris_K_F drives an FR-Slow

TractorPillow

> Chris_K_F drives an FR-Slow

04/10/2016 at 10:30 |

|

I like progressive a lot too. They were super awesome when one of their policy holders backed into my wife's car. I was very impressed with their customer service. I'm also stuck with USAA since we have accident forgiveness on our policy and my wife has taken full advantage of that haha.

fourvalleys

> nafsucof

fourvalleys

> nafsucof

04/10/2016 at 10:35 |

|

If they searched for his name, they would see pictures of him at autocross events. Videos too. So, yes.

E: I should clarify that the plates probably don't matter. If they see "Bob Smith" in his blue 2015 BRZ - and they know it's the same Bob Smith - I doubt they care what the plates say.

jariten1781

> Stang70Fastback

jariten1781

> Stang70Fastback

04/10/2016 at 10:36 |

|

That blows, first Iíve heard of it for autocrossing but itís fairly common for track cars. Thank all the assholes who limp their damaged vehicles back into a public road then claim on their standard insurance (and yes, autocrossers as well as track drivers are known to do this when they whack a curb or whatever).

The quoted sections you have include Ďcontest of speedí which, being a timed event, autocross would count as. Again, never heard of it being canceled, but thatís there.

How they find it? Forum posts are most common. OEMs trawl there as well in order to deny warranty claims. If youíve posted pictures with your plate visible or your real name thatís likely where they got it.

The Snowman

> Stang70Fastback

The Snowman

> Stang70Fastback

04/10/2016 at 10:39 |

|

Do you have the Gieco thing in your obdII port? Sorry this was a bit long, if you mentioned it in there, Iím just curious how else the would know you drive enthusiastically.

Stang70Fastback

> jariten1781

Stang70Fastback

> jariten1781

04/10/2016 at 10:43 |

|

Yeah, Iím sure my name and plate can be pieced together if they do some searching. Too much online presence these days. I like to share my experiences, so it really is hard to make it impossible for them to not find out I autocross.

Stang70Fastback

> TractorPillow

Stang70Fastback

> TractorPillow

04/10/2016 at 10:43 |

|

Unfortunately, none that are still alive, lol.

Stang70Fastback

> nafsucof

Stang70Fastback

> nafsucof

04/10/2016 at 10:44 |

|

Yeah, Iíve got enough of an online presence that they could find out I autocross if they searched. I mean I have a blog where I post about all of my autocross events, and that goes to YouTube, which is linked to other things, etc... Everything is interconnected these days.

Stang70Fastback

> fourvalleys

Stang70Fastback

> fourvalleys

04/10/2016 at 10:44 |

|

Added it to the post :)

Bourbon&JellyBeans

> Stang70Fastback

Bourbon&JellyBeans

> Stang70Fastback

04/10/2016 at 10:48 |

|

You arenít going to convince them, Iím afraid. When an insurance company thinks of ďautocross,Ē they think of this:

fourvalleys

> Stang70Fastback

fourvalleys

> Stang70Fastback

04/10/2016 at 10:53 |

|

You should color-code or indicate which comments are yours, for clarity.

Stang70Fastback

> The Snowman

Stang70Fastback

> The Snowman

04/10/2016 at 10:54 |

|

I do not.

-this space for rent-

> TractorPillow

-this space for rent-

> TractorPillow

04/10/2016 at 10:55 |

|

Nobody will cover you for on track incidents. Iíve had travelers forever and never had an issue with treats of dropping me. My agent is a Facebook friend so heíd see pics of autocrossing.

aquila121

> -this space for rent-

aquila121

> -this space for rent-

04/10/2016 at 10:56 |

|

This is disheartening.

-this space for rent-

> aquila121

-this space for rent-

> aquila121

04/10/2016 at 11:01 |

|

Read the linked thread about Porsche refusing to cover an IMS failure under warranty because of participation in PCA autocross events.

crowmolly

> Stang70Fastback

crowmolly

> Stang70Fastback

04/10/2016 at 11:16 |

|

Man, that really sucks. Sorry to hear about it, especially considering the wording in your policy.

Around here GEICO has been known to send people to drag strips to write down plate numbers.

My bird IS the word

> Stang70Fastback

My bird IS the word

> Stang70Fastback

04/10/2016 at 11:22 |

|

I donít think racing is the problem. I think that they think that the paint claim was from racing, so they paid a claim that since they donít know the truth, they(quite reasonably) think you lied about it, and canít ďtrustĒ you. That Facebook post screwed you basically. Doubt they will admit it though, you're probably going to need new insurance. This is why I am not on Facebook lol.

Jayhawk Jake

> Stang70Fastback

Jayhawk Jake

> Stang70Fastback

04/10/2016 at 11:28 |

|

Autocross isnít racing. Itís a timed driving event.

That's super shitty though. I have geico, they haven't done the same to me

Chris_K_F drives an FR-Slow

> Aaron M - MasoFiST

Chris_K_F drives an FR-Slow

> Aaron M - MasoFiST

04/10/2016 at 11:30 |

|

My old roommate used to be an insurance agent, and my insurance agent no less, and he hates GEICO.

Aaron M - MasoFiST

> Chris_K_F drives an FR-Slow

Aaron M - MasoFiST

> Chris_K_F drives an FR-Slow

04/10/2016 at 11:35 |

|

When I went over the paperwork for the bodywork, the head mechanic looked over and said to me, ďGEICO? I apologize in advance.Ē When I finally got the car back five weeks later (one week to replace the liftgate and repaint, four weeks of insurance nonsense), he was polite enough not to tell me ďtold you soĒ.

aquila121

> -this space for rent-

aquila121

> -this space for rent-

04/10/2016 at 11:41 |

|

Warranty stuff I can somewhat understand, as the ďspiritedĒ nature of pursuing the best time in autocross may incur additional/faster wear and stress on parts of the car. I always figured the insurance side of things was more a ďWe donít cover track time, so youíre on your own for fixing it and medical expenses no matter whatĒ type of thing. After reading this, Iíve changed my facebook privacy settings to be much more restrictive.

...Wait, is IMS an ignition module sensor? If so, really Porsche? You market the 911 and similar models as crazy fast and phenomenal race platforms (which Iím sure they are), then say eff that on covering an ignition failure likely not exacerbated by hard driving?

Kailand09

> Stang70Fastback

Kailand09

> Stang70Fastback

04/10/2016 at 11:42 |

|

As a small suggestion, if you need a new insurer Iíve got good prices with AAA.

Never had a claim but I've been happy.

Stang70Fastback

> Flavien Vidal

Stang70Fastback

> Flavien Vidal

04/10/2016 at 11:46 |

|

Yeah, it just sucks. If autocrossing is something they will drop you for (or any racing) then they should be upfront about it? Someone who ďdidnít know any betterĒ would be completely blindsided because their documents give no indication that this is something that they would drop you for. It just sounds like any other exclusion.

petebmwm

> Stang70Fastback

petebmwm

> Stang70Fastback

04/10/2016 at 11:46 |

|

yeah, geico......my rates went up, when i called to ask why, the answer i got was ď we petitioned your state for for a rate increase and they approved it, so....Ē basicly, we hiked it because we could and wanted to. Iím currently shoping for another carrier.

Stang70Fastback

> My bird IS the word

Stang70Fastback

> My bird IS the word

04/10/2016 at 11:47 |

|

I would love to know if that is the reason. I intend on calling the Underwriterís Office tomorrow.

Stang70Fastback

> Steve in Manhattan

Stang70Fastback

> Steve in Manhattan

04/10/2016 at 11:47 |

|

Whatís an agent? Lol. Not GEICO. At least not that Iím aware of. Itís just whoever answers the phone when you call.

Stang70Fastback

> petebmwm

Stang70Fastback

> petebmwm

04/10/2016 at 11:48 |

|

Wow. Screw that. Iím leaning towardís State Farm. They donít seem PARTICULARLY cheap, but they seem to be the best according to just about everyone.

Stang70Fastback

> Shoop

Stang70Fastback

> Shoop

04/10/2016 at 11:49 |

|

Lol. I will sue for MILLIONS in emotional damages.

Stang70Fastback

> Chasaboo

Stang70Fastback

> Chasaboo

04/10/2016 at 11:49 |

|

But they donít disallow racing in their contract.

petebmwm

> Stang70Fastback

petebmwm

> Stang70Fastback

04/10/2016 at 11:49 |

|

Liberty mutual too, they give discouts through bmw cca. ( i have bmwís)

LOREM IPSUM

> Stang70Fastback

LOREM IPSUM

> Stang70Fastback

04/10/2016 at 11:49 |

|

If theyíll take you, go with Amica.

Their rates are the best (by far), they pay out without a hassle; but they will drop your ass like itís hot if youíre at fault.

At one time you couldnít even get insurance through them unless you were referred by an existing Amica customer. I believe that has since changed, but if I were looking for auto insurance in America theyíd be my first call.

Geico have always been overpriced anyway.

Worst case, Progressive will insure anyone, for a price. Might even get a Flojob out of it.

LOREM IPSUM

> Jayhawk Jake

LOREM IPSUM

> Jayhawk Jake

04/10/2016 at 11:52 |

|

Technically a timed event still counts as racing, as you are racing against the clock.

pjhusa

> petebmwm

pjhusa

> petebmwm

04/10/2016 at 11:54 |

|

Liberty Mutual has great discounts for BMW owners. You don't even have to be a member of BMWCCA to take advantage of them.

AMGtech - now with more recalls!

> aquila121

AMGtech - now with more recalls!

> aquila121

04/10/2016 at 11:57 |

|

Intermediate shaft bearing, IIRC. It basically sits in the middle of the engine and nearly requires a full teardown. Very common on 996s (I think, Iím not a Porsche guy).

Little Black Coupe Turned Silver

> Stang70Fastback

Little Black Coupe Turned Silver

> Stang70Fastback

04/10/2016 at 12:05 |

|

Hereís the thing. You turned in a claim for damage on the same day as an autocross. Insurance companies arenít stupid, they know autox does indeed have risks for damage and is it 100% racing in their eyes. Did you have a police report that proves the damage from the road debris happened, or was it just your word? They will immediately connect the dots to the damage happening while racing, and boom, you know the rest.

I do track days, and there are many stories of cars hitting walls, and being limped to the road and claims being made for deer damage. Insurance companies are starting to crack down on racing related claims more and more, and this is the result.

Shoop

> Stang70Fastback

Shoop

> Stang70Fastback

04/10/2016 at 12:07 |

|

Just donít get legal help from Gawker.

Desu-San-Desu

> Stang70Fastback

Desu-San-Desu

> Stang70Fastback

04/10/2016 at 12:08 |

|

Iíve had really good luck with The Hartford. Very reasonable rates and every time I call, they seem to find some new way to LOWER my bill without reducing my coverage. Iíve openly told them that Iím a delivery driver and I occasionally drive my car in the mountains for fun and autocross a few times a year. They didnít know what autocross was, so I explained it to them and they were totally fine with it and just clarified they wouldnít cover any damages resulting from an autocross run.

I have a special rate through them with my bank, so my experience may be a little bit different. All I know is nobody else can touch their rates and coverage when I get quotes elsewhere. I have comprehensive coverage on two vehicles (Ď91 Audi Quattro and a Ď97 Thunderbird 4.8) and I have full coverage on my 2006 Mini Cooper S and I pay $125 a month with roadside assistance and gap coverage, including coverage for invested parts.

The only downside? Theyíre only open Monday through Friday for coverage changes. Claims department is 24/7, though.

Little Black Coupe Turned Silver

> Jayhawk Jake

Little Black Coupe Turned Silver

> Jayhawk Jake

04/10/2016 at 12:09 |

|

Track days arenít even timed, but to insurance they still arenít covered.

Stang70Fastback

> Little Black Coupe Turned Silver

Stang70Fastback

> Little Black Coupe Turned Silver

04/10/2016 at 12:15 |

|

I didnít get a police report because I didnít realize anything had done any damage until later. Initially I thought it was a tiny piece of plastic that the other car had hit, and I thought I had driven OVER it. When we stopped for gas 30 miles later, I noticed that gash in the paint. Iím sure there is a record of the accident that I could get from the police department up there to prove there was a four-car pileup there, but I donít know what else I could do to prove that the gash I got resulted from that. That was a weekend of ice racing autocross, though... so thereís no way to damage the car in that manner during those events.

nafsucof

> Stang70Fastback

nafsucof

> Stang70Fastback

04/10/2016 at 12:17 |

|

Geez that's cool/a bummer at the same time. Can't even be proud about your driving without consequence.

QCGoose

> Stang70Fastback

QCGoose

> Stang70Fastback

04/10/2016 at 12:36 |

|

I have State Farm and couldnít be happier. I donít even know who else is more expensive or cheaper to be insured with because I havenít cared to shop for anyone else.

Iíve been with them since I started driving (am 31 now) and currently have all our cars, motorcycles, and house through them. Theyíve been fantastic.

crustyjoe

> Little Black Coupe Turned Silver

crustyjoe

> Little Black Coupe Turned Silver

04/10/2016 at 12:39 |

|

Technically they should have just refused his claim.

Phunkydiabetic

> Chasaboo

Phunkydiabetic

> Chasaboo

04/10/2016 at 12:40 |

|

Thats what I thought when I read this ó ďIím not so sure autocross counts as racingĒ.

Of course it counts as racing!

Stuttgart Shuffle

> Stang70Fastback

Stuttgart Shuffle

> Stang70Fastback

04/10/2016 at 12:40 |

|

A whole article about semantics. Amazing. Shut up and get new insurance.

SNL-LOL

> Stang70Fastback

SNL-LOL

> Stang70Fastback

04/10/2016 at 12:41 |

|

Still more valid than claiming emotional damage after bragging about the sex on live radio.

BrianRad

> Stang70Fastback

BrianRad

> Stang70Fastback

04/10/2016 at 12:41 |

|

You violated Geicoís contract with you and they dropped you. You have no right to be mad.

Quasimofo

> Little Black Coupe Turned Silver

Quasimofo

> Little Black Coupe Turned Silver

04/10/2016 at 12:41 |

|

Yeah... I know all about the old ďdeer ran outĒ trick from someone who wrecked an RC30 many years ago on a track. Gotta be harder to pull that scam these days.

Stang70Fastback

> BrianRad

Stang70Fastback

> BrianRad

04/10/2016 at 12:42 |

|

You didnít read the article. I didnít violate anything. Their contract only states they wonít cover damage resulting from racing. It doesnít state that you cannot use your vehicle for these sorts of endeavors.

mshefler

> -this space for rent-

mshefler

> -this space for rent-

04/10/2016 at 12:43 |

|

I think you would just have to not tell them and not post anything on social media. I would go to track days and wouldnít post ANYTHING on social media at all. The photographer was also kind enough that he wouldnít post his photos online without your permission in case thereís one of your license plate on there

Stang70Fastback

> Stuttgart Shuffle

Stang70Fastback

> Stuttgart Shuffle

04/10/2016 at 12:44 |

|

Looks like that is what I will have to do. A contract is all about semantics, though. Thatís, like, the only thing a contract has to be good at!

Phunkydiabetic

> Stang70Fastback

Phunkydiabetic

> Stang70Fastback

04/10/2016 at 12:44 |

|

You have never heard of an insurance agent? For real? Basically they deal with a bunch of insurance companies and shop around for you to get an insurance policy that works for you.

Unless you know what you are doing it is probably best to go through an agent.

WRXforScience

> Stang70Fastback

WRXforScience

> Stang70Fastback

04/10/2016 at 12:45 |

|

My Farmerís Insurance agent is my autocross sponsor and a fellow competitor who actively recruits autocrossers as clients. I run magnets with his information on the side of my BRZ at all the events. Maybe itís time for you to drop your insurance company.

Stang70Fastback

> Phunkydiabetic

Stang70Fastback

> Phunkydiabetic

04/10/2016 at 12:45 |

|

Lol, that was in response to the OPís question about my GEICO agent. As far as I am aware I donít have a specific agent. I donít think itís like State Farm where one person handles everything. Though I was referred to a specific place to have the car looked at when I got that scrape. Maybe that guy is supposed to be my ďagent?Ē

Have Jeep, will travel.

> Stang70Fastback

Have Jeep, will travel.

> Stang70Fastback

04/10/2016 at 12:46 |

|

I just canít believe you wrote an entire blog post about this and havenít even contacted them about it.

BrianRad

> Stang70Fastback

BrianRad

> Stang70Fastback

04/10/2016 at 12:47 |

|

Standard car insurance does not cover racing period end of story. You should have looked into track day insurance.

Stang70Fastback

> WRXforScience

Stang70Fastback

> WRXforScience

04/10/2016 at 12:48 |

|

Does he want to sponsor another car? Lol. Might I ask how that works? Is it just a mutual agreement that damage resulting from those activities wonít be covered? Did you bring it up with him first? Iím tempted, while shopping for new insurance, to try to be up-front about it and work out an agreement, but I feel like thatís probably a bad idea because Iím assuming theyíll do what GEICO did and just walk away from me.

stirling.spera

> BrianRad

stirling.spera

> BrianRad

04/10/2016 at 12:48 |

|

No he didnít. The contract doesnít actually forbid racing, it just states that accidents related to racing wonít be covered.

tesla_fan

> Stang70Fastback

tesla_fan

> Stang70Fastback

04/10/2016 at 12:48 |

|

Geico dropped me not for racing, but for ďmy affiliation with the racing industryĒ. Thatís right. Not because I was racing (I donít), but because I work in the racing industry. I had similar long history with them, with no accidents and no late patments. Screw them.

Tomek G

> Stang70Fastback

Tomek G

> Stang70Fastback

04/10/2016 at 12:50 |

|

Here is the thing with Auto Insurance companies, I have GEICO too and this so called contract is shady as shit. Every 6months when I renew, I get letter of coverage, but they NEVER give me actual contract. Even if you get some paper, it is so vague that it is useless. In your case, racing. Is it defined as it should? Or is it vague definition to be used as needed? I got myself in hot water few times with Geico when they claimed something being in contract but could never provide it with writing. And it is not just GEICO, all these scumbags are the same

EmotionalFriend

> Stang70Fastback

EmotionalFriend

> Stang70Fastback

04/10/2016 at 12:50 |

|

Thereís your problem. Never do business with a huge company like that unless that company has local representatives who have some skin in the game. The job of that rep in cases like this should be to fight against the company for you from the inside. Some guy in a call center doesnít really care if you go to State Farm. It doesnít hurt his bottom line personally and heís not going to fight for you heís going to do what heís told. Someone in your community is going to fight to keep your business because itís not just Geicoís name on the line itís theirs as well.

Stang70Fastback

> tesla_fan

Stang70Fastback

> tesla_fan

04/10/2016 at 12:50 |

|

Well that sucks. I suppose their approach to low rates is to just cut off anyone who they think might possibly in any way, shape or form cost them even more than the standard Joe Schmoe.

LoudmouthOne

> BrianRad

LoudmouthOne

> BrianRad

04/10/2016 at 12:51 |

|

Did you read ANY of the article???

He knows that like anyone does, he isnít making a racing based claim, heís not asking to be covered while on a track, heís being dropped for standard commuting on a car he HAD taken to the track.

Read before commenting.

windadvisory

> Stang70Fastback

windadvisory

> Stang70Fastback

04/10/2016 at 12:52 |

|

No. That was your claims adjuster.

When choosing insurance think small and find a company that is fairly local. If your carrier has a TV commercial be prepared for disappointment in the event of a loss.

User1312

> Stang70Fastback

User1312

> Stang70Fastback

04/10/2016 at 12:52 |

|

The fact that they donít cover a car in preparation for a race suggests there may be some verbiage relating to the transit to/from a race as well.

Stang70Fastback

> Have Jeep, will travel.

Stang70Fastback

> Have Jeep, will travel.

04/10/2016 at 12:52 |

|

I did speak with a standard agent briefly on the phone, but all she could tell me was, ďYeah, you race your car. We donít cover that.Ē I tried to tell her that the contract simply says you wonít cover damage resulting from that, not that you wonít cover the car the rest of the time, but she didnít seem to understand. I wrote this on Oppo as a way to vent. Wasnít expecting it to get boosted to the Jalopnik home page. If Iíd known that would happen, I would have waited until I spoke to their proper department on Monday, lol.

wlb50

> Stang70Fastback

wlb50

> Stang70Fastback

04/10/2016 at 12:52 |

|

Maybe you ran over that obnoxious lizard in the lot.

How would they know you were ďracingĒ?

Personally I tried calling them after that 15 minute claim nonsense on the phone, and felt the process of ďgetting approvedĒ was too arduous.

I have also over the years not turned in small stuff like windshields - they donít forget.

Been with the same company for 20 years although having changed owners 3x thinking of leaving. Was with AAA for 20 years before them.

ljksetrightmemorialtrophydash

> BrianRad

ljksetrightmemorialtrophydash

> BrianRad

04/10/2016 at 12:53 |

|

Youíve missed the point again .

Clutchman83

> Phunkydiabetic

Clutchman83

> Phunkydiabetic

04/10/2016 at 12:53 |

|

I think GEICO sells to a lot of people direct. Itís so easy to just get a quote from a whole smorgasbord of places online these days. Iím surprised anyone uses an insurance agent at all, Iíve never used one and my insurance rates are lower than most of my family and friends.

RelentlessSlacker

> Stang70Fastback

RelentlessSlacker

> Stang70Fastback

04/10/2016 at 12:53 |

|

Interesting. Iíve called my State Farm agent before HPDE events to make sure Iím covered and heís like, yes, you are, quit asking. Sorry about GEICO...especially when they try to hard to advertise to enthusiasts.

Battery Tender Unnecessary

> BrianRad

Battery Tender Unnecessary

> BrianRad

04/10/2016 at 12:53 |

|

He didn't try to claim a track related accident. They're just saying because you like to enjoy your car in the relative safety of an empty parking lot we aren't going to cover you when driving on a highway full of bad drivers.

Joan Barreda Borts 3rd Knee

> Stang70Fastback

Joan Barreda Borts 3rd Knee

> Stang70Fastback

04/10/2016 at 12:53 |

|

If it were me, I wouldnít call them to discuss it, Iíd just go to another company.

Theres nothing to be gained from calling them, its their decision, even if they decide to take you back on, your file will always have a note next to it, and any claims you make will be gone over for any excuse to reject.

The problem with AutoX or track events is people have wrecked cars, pushed them to the road, and made claims when they werenít covered. This makes it worse for the rest of us.

Insurance companies arenít stupid, they may be wrong in your case with your claim, but you still made a claim on the same day you were racing, which looks suspicious.

Kinpolaj 3000

> Stang70Fastback

Kinpolaj 3000

> Stang70Fastback

04/10/2016 at 12:53 |

|

I think this yahoo got dropped too.

Stang70Fastback

> BrianRad

Stang70Fastback

> BrianRad

04/10/2016 at 12:54 |

|

Not sure if you read my whole post, but I know it doesnít cover racing. It says this multiple times in the contract. It says they wonít cover damage or claims resulting from racing. Racing is excluded in the coverage. It doesnít, however, say you canít race your car. I never expected my car to be covered while racing. If I ever did a track day, I was going to buy track insurance. I have GEICO for the same reason anyone else has it - for the rest of the time Iím driving my car.

TL;DR, the verbiage in the contract excludes coverage in racing, but doesnít state they wonít cover the car at all if you do.

hike

> Stang70Fastback

hike

> Stang70Fastback

04/10/2016 at 12:54 |

|

Iíve got State Farm and also previously worked in a body shop that did mostly Gieco. Gieco is crap and used the cheapest repair parts that never looked right. State Farm has always been good to me and used OEM parts at the body shop I worked at. I'd recommend State Farm for sure.

User1312

> Stang70Fastback

User1312

> Stang70Fastback

04/10/2016 at 12:55 |

|

A nearby racer could have driven over debris from an earlier collision, just as happened on the road. Or someone could have slid into you at slow speed while lining up..

TC-Ruu

> Stang70Fastback

TC-Ruu

> Stang70Fastback

04/10/2016 at 12:55 |

|

Simple really from a blood sucking business standpoint.

....the fact that you do participate in ďprearranged events for ~speedĒ (lets face it, itís a time trial - that means ďget through the course fastĒ) youíre technically violating the contract. Now, you can mince words and potentially pay some guy in a suit a lot of money to argue that in court - but even if you win - all theyíll do is use said activity to increase your premium. Face it, they saw a reason to drop you, and keep the hundreds of thousands of dollars youíve paid them before they might have to actually use any of it to pay out a claim.

Jimmy Joe Meeker

> Stang70Fastback

Jimmy Joe Meeker

> Stang70Fastback

04/10/2016 at 12:55 |

|

GEICO has been doing this stuff forever. This is the expected behavior.

GEICO used to and may still buy radar guns for police departments. GEICOís evil is well known in automotive enthusiast circles. If you drive an appliance you picked because of its ratings in consumer reports and only go to work and back, the grocery store on saturday and church on sunday then go with GEICO. If you do anything more than that itís probably not a good idea to go with them. Actually even that person, should he have a claim might find himself dropped by GEICO.

Stang70Fastback

> windadvisory

Stang70Fastback

> windadvisory

04/10/2016 at 12:56 |

|

Iím tempted to go that route. It couldnít hurt, I suppose. Iím just always worried about the fact that you really donít know how things will go until after youíve had an accident or something... and I donít want to find out only then that Bobís Insurance actually sucks, lol.

Boter

> WRXforScience

Boter

> WRXforScience

04/10/2016 at 12:57 |

|

Thatís pretty awesome!

Stang70Fastback

> User1312

Stang70Fastback

> User1312

04/10/2016 at 12:57 |

|

The wording I quoted above is all it states, so youíd have to extrapolate from that statement. There isnít much to go on, but I would hope driving to somewhere wouldnít be excluded. That would be silly :P

Boter

> Stang70Fastback

Boter

> Stang70Fastback

04/10/2016 at 12:58 |

|

GEIGO cheaps out where they can. I think if youíre up front about it, and state that youíre fully aware that any damage or injuries incurred while ďracingĒ wouldnít be covered, youíll find someone willing to cover you. Farmerís, Liberty Mutual, State Farm, etc.

Like a good pit crew, State Farm is there...

smobgirl

> tesla_fan

smobgirl

> tesla_fan

04/10/2016 at 12:58 |

|

Wow. That's pretty absurd.

alrockaz1

> Stang70Fastback

alrockaz1

> Stang70Fastback

04/10/2016 at 12:59 |

|

GEICO has a reputation for quickly dropping anyone thatís anything but the lowest risk. I would never seek them for auto insurance (or any other insurance).

windadvisory

> My bird IS the word

windadvisory

> My bird IS the word

04/10/2016 at 12:59 |

|

Using Facebook to crowd source a body shop recommendation the day after your autocross event. Later dropped from your insurance because you autocross.

If a quarter was deposited into a bank account every time Facebook was used in a way that created a problem that otherwise would not exist I am pretty sure we could address world hunger.